Exchanging turn point technique has been well known for intraday dealers for quite a while now. Same standards for utilizing this methodology as in most other help/obstruction systems. Nonetheless, there is a distinction as the significant help/obstruction levels called rotate focuses are determined utilizing every day high, low and close. Thusly, they are fixed for the entire day and can assist you with arranging potential zones of enthusiasm for advance.

What Is A Pivot Point?

Turn point is another specialized examination pointer that most exchanging stages offer. It depends on the earlier day’s normal of high, low and close. Thusly, when the value moves over this level the following day, we can accept the market bearing is bullish or the other way around when the value exchanges underneath this level.

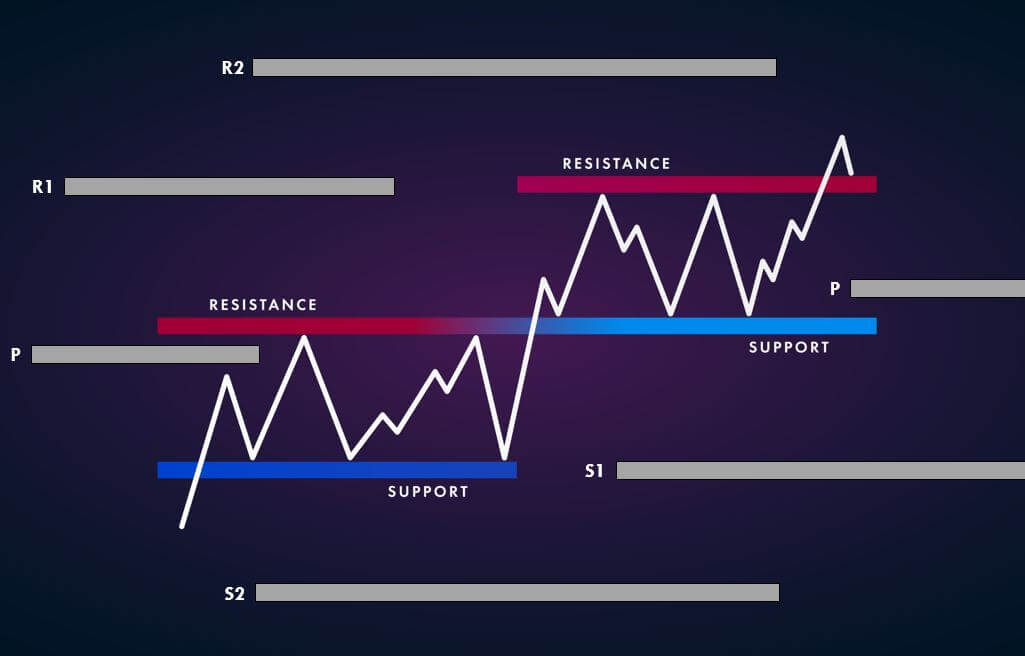

Notwithstanding the fundamental turn point, there are normally at any rate 4 additional levels called: S1, S2, R1, and R2. They demonstrate further help and opposition levels for the afternoon and can be utilized to set an objective revenue driven taking, exchange passage or stop misfortune. These levels can likewise be utilized to search for advertise inversions or continuations similarly as normal value activity support/opposition levels.

The primary distinction, when contrasted with different markers, is that the levels stay static for the duration of the day. This takes into account arranging potential exchanging open doors for the afternoon. Besides, long haul merchants can utilize week by week or even month to month rotate guide figuring toward plan potential help/opposition levels quite a while ahead of time.

How To Calculate Pivot Points?

As referenced previously, the turn point is determined dependent on the normal cost of earlier day’s high, low and close. Along these lines, the equation is following:

Turn Point (P) = (High + Low + Close)/3

Following first help/opposition levels are then determined dependent on the rotate point and either high or low os the day by day cost:

First Resistance (R1) = (2xP) – Low

First Support (S1) = (2xP) – High

After this, the second degree of help/obstruction levels are determined as follows:

Second Resistance (R2) = P + (High – Low)

Second Support (S2) = P – (High – Low)

Different techniques for turn point computation exist, in any case, they are not as often as possible utilized and likely won’t be found on your exchanging programming. Peruse more on this here.

How To Use Pivot Points?

Turn focuses are typically utilized similarly as customary help/opposition levels. They show potential zones of intrigue and can be utilized to set benefit targets, stop misfortunes, and so forth. Since they stay static for the entire exchanging after quite a while after earlier day closes and new turn focuses are recalculated, this takes into consideration simple exchange arranging.

A straightforward case of how to utilize turn focuses is purchase the market once it begins exchanging over the focal rotate with the desire that the main opposition (R1) will be reached and, along these lines, can be utilized as a benefit target. This is on the grounds that these pointers suggest that the market will follow exchanging either above or underneath the focal turn. Subsequently, exchanging contrary to this dependable guideline isn’t fitting.

Furthermore, turn focuses can be utilized along with different pointers. Moving midpoints and energy oscillators can be an incredible blend when utilizing turn focuses for expansion intersection. Besides, customary help and obstruction levels despite everything sway the value moves, along these lines, they ought not be overlooked. Most famous exchanging stages offer a rotate point pointer, consequently, joining them is a snappy and simple procedure.

Time spans And Pivot Points

As a rule, rotate focuses are built up on a higher time span than the one you are exchanging. This implies a broker that pre-owned 4-hour outlines should hope to utilize every day rotate focuses and a day by day time period dealer should utilize week by week turn focuses. This takes into consideration progressively precise potential help/opposition levels, be that as it may, utilizing the turn purpose of the equivalent time period can likewise be utilized for an increasingly forceful methodology.

Peruse further on the most proficient method to utilize various time periods here.

Case Of Pivot Point Strategy – London Session Open.

A typical system among dealers who use rotate focuses is the exchange section dependent on the London meeting’s open. London meeting opens at 8 am GMT and is significant on the grounds that the time large banks and brokers start their activities.

Hence, after the initial 15 minutes have passed, a position is taken dependent on whether the cost is above or underneath the focal rotate point. In the event that the market exchanges underneath the focal rotate – a short position is taken with the objective of S1. Then again, if the market exchanges over the focal turn – a long position is taken with the desire that R1 will be reached. Be that as it may, if the cost has just moved excessively far away towards ether the following help or obstruction, it is ideal to avoid the exchange as the potential hazard/reward isn’t justified, despite any potential benefits.

When the particular position is taken, a stop-misfortune is put either somewhat above or underneath the focal rotate to shield yourself from misfortunes for the situation that advertise energy has moved. Further, a benefit target is set up either as S1 or R1, contingent upon whether a short or long position is taken separately. Moreover, you can utilize incomplete benefit taking at the primary help/obstruction and leave open rest of the situation until the following help/opposition level is reached as S2 or R2 separately.

Key takeaways:

Turn focuses are determined dependent on the normal cost of earlier days/weeks/months high, low and close, in any case, different techniques can likewise be utilized.

They offer static degrees of help/opposition, hence, permitting to design exchanging advance.

They are exchanged a similar way that standard help/opposition levels, nonetheless, are not emotional as they are determined utilizing a recipe.

In view of whether the market is exchanging above or beneath the focal rotate point, the market assumption can be resolved for the particular time frame.

Utilizing extra specialized investigation instruments, for example, moving midpoints, normal help/opposition levels, pattern lines just as energy pointers can additionally assist with building up showcase assessment and levels of intersection.